Home inspection claims can happen even to the most careful inspectors. Understanding how to respond quickly—and knowing how your insurance coverage protects you—can make the difference between a resolved complaint and a costly claim.

At EliteMGA, we believe claims prevention is just as important as claims management. That’s why EliteMGA, Inspector Claim Management (ICM), and InterNACHI have worked together to create a proactive, worry-free approach to handling home inspection complaints and claims. Led by Joe Denneler, General Counsel for EliteMGA and the Elite family of companies, our claims advocacy team brings decades of experience defending home inspectors nationwide.

In this guide, you’ll learn:

The most common home inspection claims

The difference between a complaint and a claim

EliteMGA’s Worry-Free Reporting system

Proven tips for managing customer complaints professionally

Common Home Inspection Claims (and How to Avoid Them)

Even the most thorough inspections can sometimes lead to client concerns. How you respond to these concerns matters, not just for resolving the issue, but for protecting your reputation and your business.

The most common home inspection claims brought against home inspectors typically fall under either General Liability or Errors & Omissions (E&O) coverage. Home inspector claims generally include one of the following allegations:

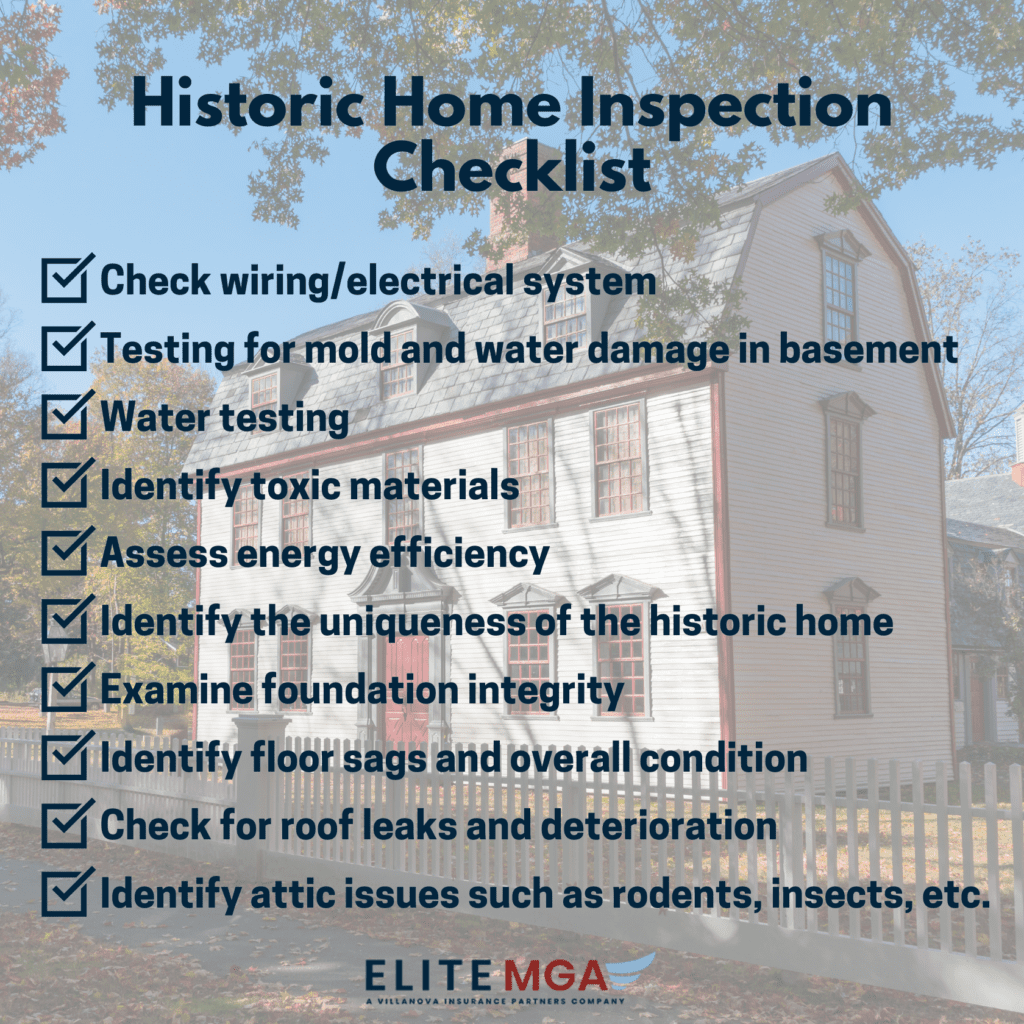

- Roofing issues

- Mold concerns

- Plumbing problems

- Defects in the foundation

- Water damage

Many of these claims stem from misunderstandings about inspection scope or delayed reporting of concerns. Prompt reporting and clear documentation are critical to protecting your business, your reputation, and your insurability.

Claims can be reported on our website at Report A Claim. Our goal is to keep you free of such situations and work to maintain your insurability and keep your premium costs manageable. For the industry’s best protection, contact one of the team members at EliteMGA today.

Have Questions? Contact EliteMGA Today!

Two Key Resources for Dealing with Customer Complaints

- Proactive Reporting

Our Worry-Free Reporting system helps you report incidents early, without fear of triggering claims or higher premiums. Protect yourself before small issues become bigger problems.

- Practical Tips

Get actionable guidance on handling customer complaints professionally and effectively, from staying calm to documenting and resolving concerns.

What Is The Difference Between A Claim And A Complaint?

From the legal perspective, there is a significant difference between a claim and a complaint.

A complaint is an expression of dissatisfaction and may be made even when no error or injury occurred. Complaints often include a perceived issue and a desired resolution.

A claim typically involves a demand for compensation or legal action.

At EliteMGA, we treat complaints and claims with the same urgency. Addressing complaints early is one of the most effective ways to prevent them from becoming formal insurance claims.

How to Report a Home Inspection Claim to Your Insurance

Regardless of its size, reporting a home inspection issue to your insurance should be the first step in handling a home inspector claim brought against you.

Once notified, EliteMGA and ICM’s attorneys and claims professionals work proactively to:

- Evaluate exposure

- Defend contractual protections

- Resolve issues before escalation

To assist in strategy development, inspectors should be prepared to provide:

- Inspection reports

- Pre-inspection agreements

- Photos and documentation

- Client communications

Does Reporting a Home Inspection Claim Affect Your Insurance Premiums?

EliteMGA and Inspector Claim Management (ICM) offer a Worry-Free Claims Reporting process designed specifically for home inspectors.

If your matter does not involve litigation and EliteMGA is not paying indemnity or legal defense fees, it does not count as a claim under your policy. In simple terms: if we pay nothing, you pay nothing.

This approach allows home inspectors to report complaints and incidents early—without fear of automatic premium increases or negative impacts on insurability. Early reporting gives our claims professionals the opportunity to assess risk, provide guidance, and help prevent minor issues from escalating into formal claims.

Proactive Worry-Free Reporting for Home Inspectors

Preventing claims starts with setting clear expectations from the beginning of every inspection. Experienced inspectors know that clearly explaining what an inspection includes—and what it does not—can significantly reduce misunderstandings. When concerns arise, referring back to your inspection agreement and calmly explaining the scope of work often prevents complaints from escalating.

That’s why EliteMGA created Worry-Free Reporting. Inspectors should never hesitate to report an incident, big or small. Failing to report an issue early can leave you exposed if a complaint later develops into a claim.

How Worry-Free Reporting Protects You

- Reporting incidents early does not affect your premiums or your ability to purchase insurance

- You receive claims management support from experienced attorneys and claims professionals

- We assist with pre-litigation matters and help resolve issues within your deductible when appropriate

- Settlement agreements include confidentiality provisions to protect your reputation

- For frivolous claims, we craft professional responses asserting contractual defenses outlined in your inspection agreement

This claims management system was developed through decades of experience advocating for home inspectors. With the combined expertise of ICM, EliteMGA, and InterNACHI, we guide inspectors through every step of the process—protecting their business, reputation, and long-term insurability.

Your first call should always be to us. We’re here to help before a small incident becomes a claim.

How to Prevent Home Inspection Claims Before They Start

The best way to handle claims is to prevent them in the first place. Keeping detailed inspection reports, maintaining transparent communication with clients, and using strong pre-inspection agreements can significantly reduce claim risk.

Ultimately, preventing home inspection claims comes down to diligence, documentation, and proactive communication. By setting clear expectations, keeping thorough records, and addressing concerns as soon as they arise, you can stop small issues from turning into major claims. Partnering with an experienced insurance provider like EliteMGA gives you an extra layer of protection—offering guidance, resources, and a worry-free claims process that helps you stay focused on delivering high-quality inspections with confidence.